It’s all about the city: Adelaide’s strength masking pain for country cousins

SA’s city dwellers are prospering but much-touted strong economic figures are leaving their country cousins in the cold. InDaily explores what’s happening outside the city perimeter.

Adelaide’s growing economy is propping up the state, new research has found, and is masking how most rural regions in South Australia are struggling with negative growth over the past financial year.

A deep dive into the recently released Gross State Product figures – hailed by the State Government as the “latest positive endorsement” of SA’s economic direction – by BDO’s SA-based chief economist Anders Magnusson, found “published statistics can obscure significant regional disparities”.

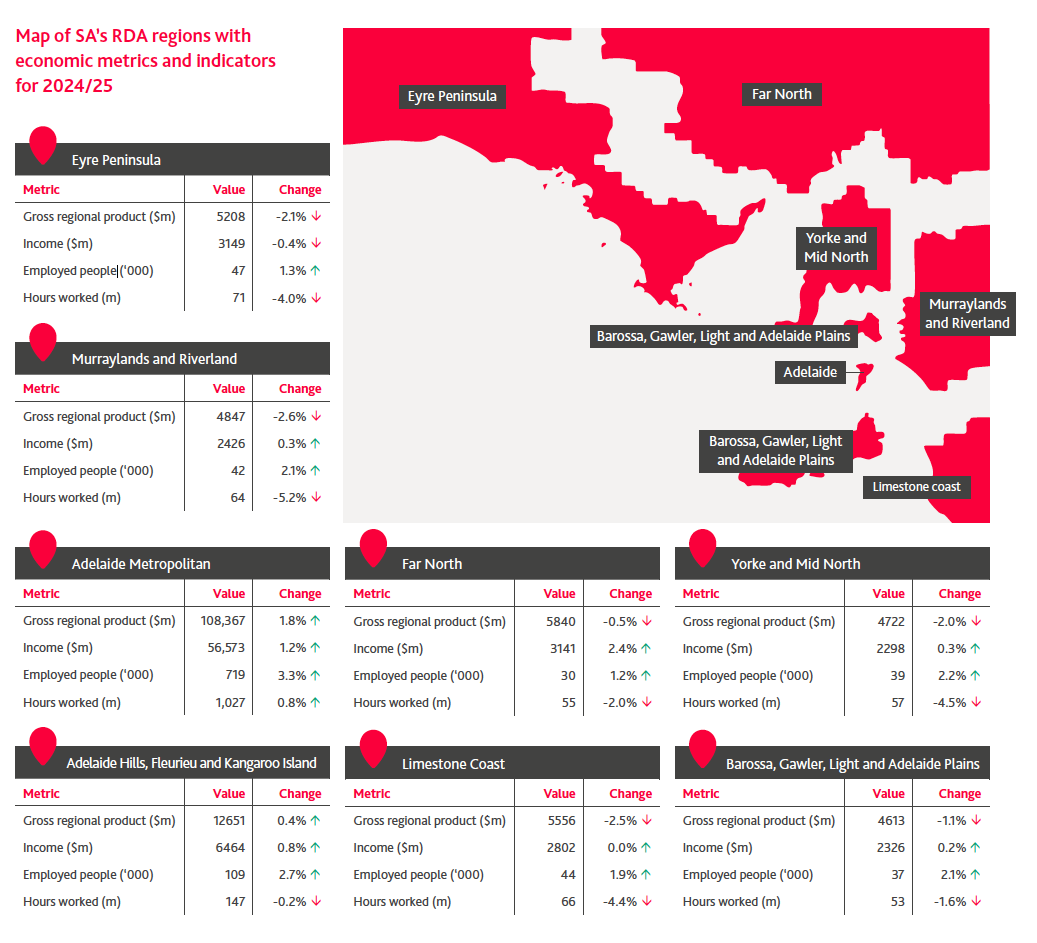

Adelaide’s 1.8 per cent economic growth drove South Australian Gross State Product growth of 1 per cent. But this was dragged down by some rural regions experiencing negative growth by up to 2.6 per cent.

And regions are struggling across the state with the Murraylands and Riverland, the Limestone Coast and Eyre Peninsula facing the toughest downturns as they grapple with the impact of drought and flood recovery, fruit fly and rising costs.

Regional Development Australia Murraylands and Riverland chair and Bowhill Engineering CEO Jodie Hawkes told InDaily the “statewide economic figures tell a pretty positive story, but they also smooth over the reality that some regions are doing it really tough”.

“I wouldn’t say the regions are ignored, but the headline numbers don’t reflect the pressure many businesses in the Murraylands and Riverland are feeling on the ground,” she said.

“Our region is still juggling drought, flood recovery, fruit fly and rising costs. The combined impact has worn down community resilience – our volunteers are tired, and our small businesses are constrained even while they’re doing their best to keep people employed.

“What our region really needs is long-term, consistent backing – not stop–start, one-off programs that disappear just as people start to rely on them. Real resilience comes from investing in local leadership, mental health and the strength of our businesses – including helping them build a financial ‘war chest’ so they’re better prepared for the next disruption.”

She said there was an upside for her region: “The Greater Adelaide Regional Plan identifies Murray Bridge as a key growth centre, and with the right long-term policy settings and investment, regions like ours can deliver serious returns in jobs, productivity and liveability for the whole state”.

You might like

South Australian Business Chamber CEO Andrew Kay said he welcomed the growing complexity and diversity of the state’s economy, but “this should not be at the expense of key sectors”.

“We need to ensure the longevity of our agriculture and aquaculture communities as we embrace opportunities in critical minerals and defence-related industries,” Kay said.

“Our regions still face significant challenges in attracting workers, housing affordability and availability, access to training and cost of doing business.

“We need to encourage greater regional investment, which is why the SA Business Chamber is advocating for Government to introduce a 50 per cent payroll tax discount for regional businesses to make us more competitive with our interstate counterparts.”

Negative Gross Regional Product growth was down across all of the state’s regions, except for Adelaide Hills, Fleurieu and Kangaroo Island, which grew by just 0.4 per cent.

It was worst in Murrayland and Riverland (down 2.6 per cent), Limestone Coast (down 2.5 per cent) and Eyre Peninsula (down 2.1 per cent).

BDO research said the downturn in rural SA was associated primarily with severe drought, with the regions heavily focused on just a few industries like agriculture, forestry, fishing and mining.

“The impact of the drought on regional economies has been masked by the growth in Adelaide, and with SA’s population heavily concentrated in the capital city, many people might not be aware of the reality faced by our agricultural, forestry and fishing communities,” he said.

“The story will be different in the different regions; it isn’t all just because of the drought.

“In the Murrayland and Riverland, I would expect wine grapes to be part of that story – the industry has been suffering and trying to work out what to do for several years.”

Stay informed, daily

The Riverland’s peak body said its more than 900 South Australian Riverland wine grape growers and 25 wineries were in the “grip of a social and economic emergency” as plunging grape prices fail to come close to covering production costs.

| Sponsored |

And the algal bloom crisis off the coast of South Australia – that’s caused the deaths of thousands of marine animals and decimated the aquaculture and coastal tourism industries – was expected to have an impact in the current financial year.

“I think it’s more likely we’ll see the impact of that really a year from now, when the current financial year’s numbers are published,” Magnusson said.

“But there is a cause for optimism as people head back to the beaches and discover there is plenty to do this summer.”

SA’s growth was bolstered by its heavily service-oriented employment makeup, with 86 per cent of GSP generated by services.

BDO found professional services, health, education and finance sectors led the way, while construction also contributed to modest growth.

In Adelaide, the growth sectors were residential construction, finance, insurance services and healthcare, Magnusson said.

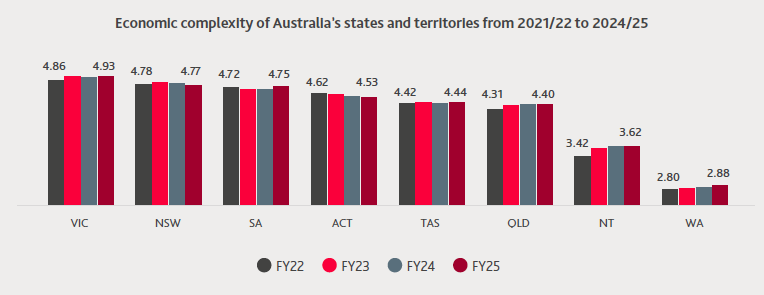

South Australia’s economic complexity score was strong compared to other states and territories, BDO found.

“The higher the economic complexity of an economy, the more productive you would expect it to be,” he said.

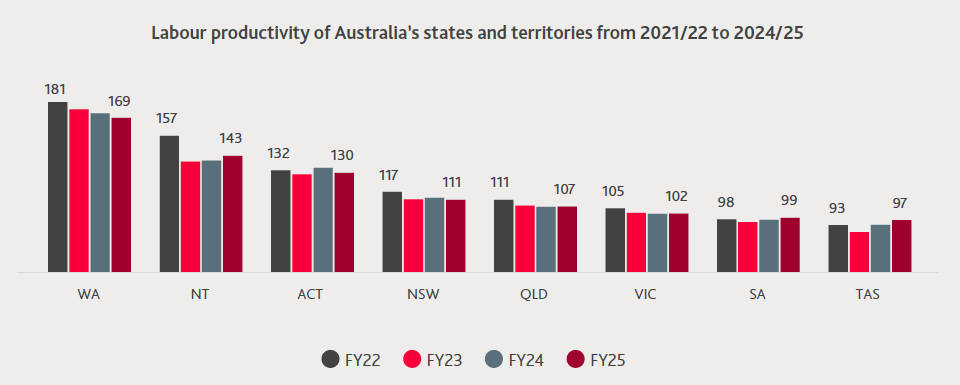

But while productivity rose, SA remains one of the weaker jurisdictions.

“SA isn’t a boom and bust state, like a lot of others,” Magnusson said.

“While labour productivity is relatively low, and complexity is in the middle of the pack, the relatively high diversity of the SA economy cushions it against downturns in any particular market or industry, leading to the stable growth that characterises the state.”

He said productivity was “not growing quickly enough”, which puts the state at risk of “falling further behind the other states”.

“Opportunities for improvement lay in promoting modern construction methods, keeping the momentum on infrastructure upgrades and enabling migrants with the skills that SA businesses really need to live and work in SA.”