Adelaide office vacancy rise led by swish stock coming online

Exclusive: The number of empty offices in Adelaide has crept up but figures sit well below one eastern state. The Property Council reveals what’s driving the trend in its latest data.

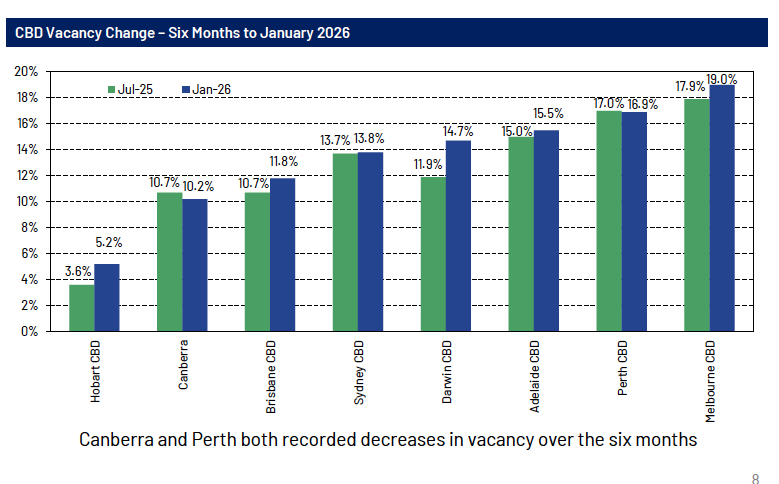

Office vacancy in the Adelaide CBD rose by half a per cent to 15.5 per cent over the last six months of 2025, new Property Council of Australia data shows.

Despite rising by half a per cent from the end of June 2025, the Property Council of South Australia’s executive director Bruce Djite and analysts said it was not a cause for concern.

New builds and quality refurbishments are instead driving the rise, Djite said.

“A-Grade and well-located buildings continue to attract tenants, and this will continue as the complexity of our economy increases and employers look for quality and amenity,” Djite said.

“Older stock continues to increase in vacancy due to sitting in a market where there is little incentive to upgrade, and many D-grade buildings make up the bulk of the CBD’s structural vacancy.”

During the half, 50 Franklin Street came to the market. The new building, designed by architects Brown Falconer, sports 21,000 sqm of premium office space spread across 17 floors. There is still space for lease in the all-electric building, which boasts environmental design, premium amenities, and intelligent building systems.

The data places Adelaide’s CBD as the third most-vacant in the country, behind Perth (16.9 per cent) and Melbourne (19 per cent).

But the situation is far better than rates experienced two years ago when Adelaide’s CBD had the highest vacancy rate in the nation of 19.3 per cent, and it is also below last year’s rate of 16.4 per cent.

You might like

The Adelaide CBD vacancy rate was just above the national average, which also increased by half a per cent to 14.8 per cent in the six-month period to January 2026.

Djite said the results pointed to a market with a strong net demand of just over 10,000 sqm for the period – above the historical average of 5000 sqm.

Government tenancies were playing a “critical role” in the Adelaide CBD market and can “materially influence demand outcomes”.

“Public sector tenancies choices matter here more than in larger cities,” he said.

“They can help stabilise demand and support confidence, particularly during periods of adjustment.”

More new stock will enter the market soon, including Market Square at 30 Gouger this year and the second Festival Tower in 2028.

Chushman and Wakefield director and head of office leasing SA Adam Hartley said the Adelaide office market ended 2025 with sustained momentum.

“Demand for smaller, speculative fitted suites continues to dominate, driven largely by small to medium enterprises seeking high-quality accommodation without the risk, delays or cost uncertainty associated with bespoke fit outs,” Hartley said.

“Larger corporate occupiers are similarly prioritising fitted space, with new non-fitted options proving most attractive to government agencies and national or global organisations requiring tailored design elements.”

Stay informed, daily

Hartley said the trend observed late in 2025 had carried into early 2026, with tenants progressing leasing decisions and equity volumes outpacing those seen at the same time last year.

This indicates that “office demand is set to remain resilient”, he said.

“Discussions with occupiers reveal that businesses are still navigating the long-term implications of flexible working models, particularly how hybrid arrangements influence future space requirements and the level of amenity expected from modern office buildings,” said Hartley.

“Whilst the office vacancy is likely to increase in mid-2026, this is due to new buildings coming online, and not a true reflection of market sentiment.”

Rundle Mall corner shop for sale

A rare corner of Rundle Mall is expected to attract strong buyer demand as it hits the market this week.

The lower levels of the Unihouse building, consisting of three shops anchored by national retailers Chemist Warehouse and Oscar Wylee, are for sale via brokers Knight Frank.

Knight Frank said the property had net passing income of $837,488 per annum, and is being sold via an expressisons of interest campaign.

Last year, neighbouring property 150 Rundle Mall was sold to National Retail Group for $10.85 million.

“Last year 150 Rundle Mall was hotly contested by buyers, and we expect this property to be met with the same level of investor interest,” Knight Frank agent chet Al said.

“There are limited opportunities to buy into Rundle Mall, with assets on this strip being very tightly held, and the corner holdings are extraordinarily rare.”

Earlier this week, InDaily reported spending records at Rundle Mall were smashed during the festive season with shoppers spending the most they ever have in history.

Adelaide Economic Development Agency (AEDA) data revealed $158 million was spent by more than 4.5 million visitors across the month.

The expenditure marked a four per cent increase from December 2024 expenditure , which was the previous monthly spend record.