Top-end shakeup as tech firm displaces perennial SA Business Index leader

One South Australian tech company’s climb up InDaily’s South Australian Business Index has seen a longstanding list-leader slide from its perch, writes Business Editor David Simmons.

Having progressively risen up the ranks of the South Australian Business Index over the years, Codan has finally dethroned an oil and gas giant that has consistently held a top four position since 2018.

The ASX-listed metal detector and communications business, valued at $3.6 billion as of June 30, 2025, has jumped into third place in this year’s most-trusted ranking of South Australian businesses.

Unveiled today at InDaily’s sold-out South Australian Business Index lunch, Codan rose above oil and gas company Beach Energy.

Beach has maintained a top-four position since 2018. The only year it fell out of that level was in 2017, when it was ranked sixth. Last year, the firm rose into third position following BHP’s acquisition of Oz Minerals meaning that company fell out of contention.

Read more: SA’s top 100 companies: The full list for 2025

Codan’s ascent has been steady since 2016 when it was ranked at number 20. It jumped around the top 20 in the following years, but was ranked at number four in 2024.

Its rise this year is backed by a growing market capitalisation that is showing no signs of slowing down and is on the back of the purchase of a US-based communications company called Kägwerks.

That $33.6 million purchase saw the South Australian tech business shake up the Top 10 this year, and added a global leader in tactical operator-worn networking communications technologies for defence environments to its portfolio.

It looks like it could next year dethrone Argo Investments, which is once again ranked second this year after perennial leader Santos. In the three-and-a-half months since June 30, Codan’s market capitalisation has nearly doubled to $6 billion.

“If they continue on this trend, I wouldn’t be surprised to see them in second place next year,” HLB Mann Judd partner Katelyn Adams said.

You might like

Codan’s story is just one of many that readers will discover in the 2025 South Australian Business Index.

The lunch was attended by Premier Peter Malianuskas, who addressed more than 450 attendees.

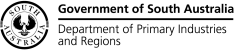

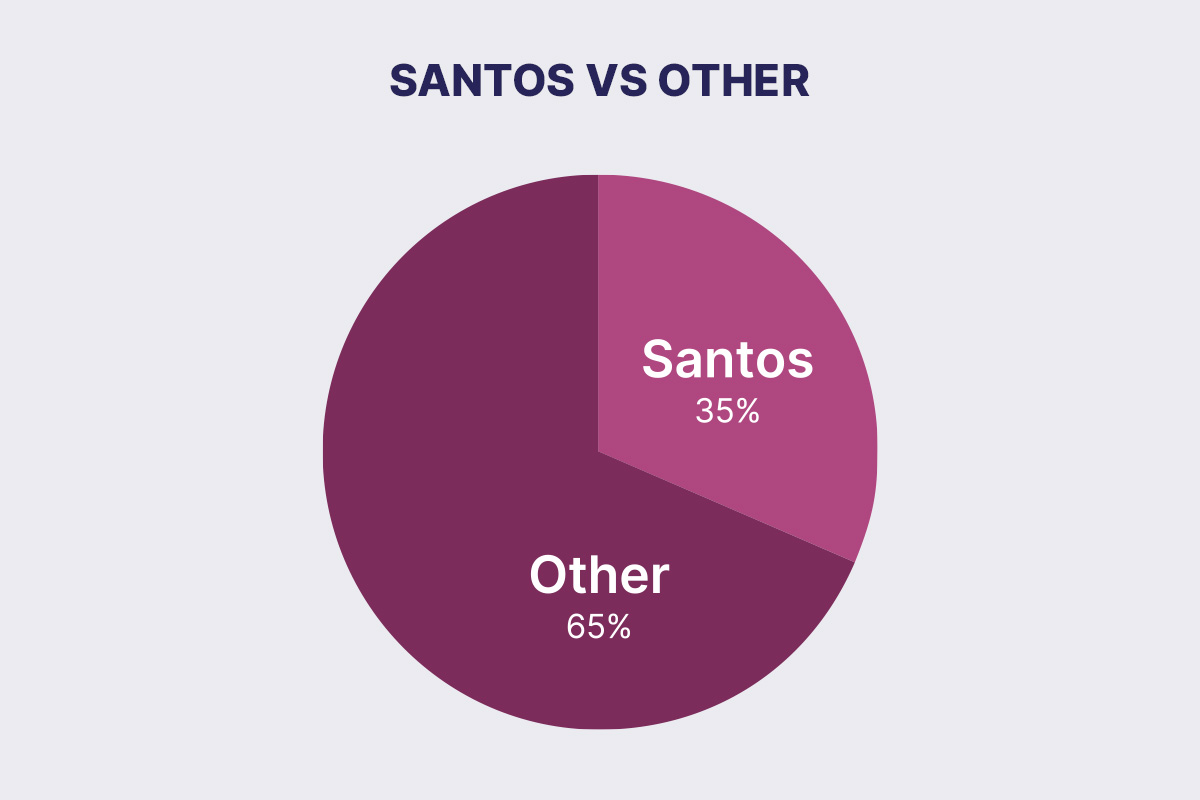

This year, Santos maintained its top position. It is so much larger than Argo Investments that, by value, it makes up 35 per cent of the total value of the list: $70.1 billion in 2025.

This total value is up on the past three financial years, and nearly $10 billion more than 2024.

“The value of the Index has risen back to the $70 billion mark, which is 2023 levels when we still had Adbri and Peregrine in the list,” Adams said.

“I think this speaks volumes of the strength of the SA sector in the past year and the performance of our top companies.”

Oil and gas as an industry continues to dominate the list by value, making up 40 per cent of the Index, Adams said, while the list also demonstrates the strength of the state’s construction sector.

“Interestingly, our tech players continue to do a lot of the heavy lifting,” said Adams.

“Almost $5 billion of the value of the index is being held between only five companies: Codan, Leader Computers, Chyrsos, Archer Materials and IonDrive.

“We have seen an industry shift in this year’s Index towards civil and construction and engineering services, with a combined share of 21 per cent of the Index, a quantifiable reflection that construction activity in SA really is at record levels.”

Though there are fewer public companies on the Index than private, the 28 ASX-listed companies make up 64 per cent of the list’s total value ($45.1 billion).

By number of companies, civil and construction is the most dominant, followed by manufacturing and resources.

Stay informed, daily

There are 24 new entrants in the Index this year, representing 15 different industries.

“This goes to show the depth and breadth of industry we have in SA,” Adams said.

“A few notable entries for me are Hickinbotham Group, entering in the list for the first time at a very respectable 14th place.

“Coming in at the other end of the list at 99 is first-time entrant Kennett Construction. This is a strong reflection of the shift in the Index toward civil and construction companies in 2025.”

One company that stands out from the lot is the winner of the South Australian Business Chamber’s Rising Star Award, given to a company that has risen the highest on the list for 2025.

This year, Petratherm was the recipient. Last year, it was ranked outside of the 100, and on the back of a major discovery of high-grade titanium-rich heavy minerals, its valuation went gangbusters. This year, it ranked at number 58.

“Petratherm is a great story. A pioneer in geothermal energy, the company had to pivot back to mineral exploration in 2018, which saw them having to re-list on the ASX,” Adams said.

“In late 2024, the company announced a major discovery of high-grade titanium-rich heavy minerals sands (HMS) over a large area at their Muckanippie project. A string of successful drilling results has continued in the area and led to heavily supported capital raisings in late 2024 and early 2025.

“As of early this month, a successful drill program has significantly extended the high-grade HMS at the Rosewood prospect and identified a new HMS zone. Keen eyes will be watching as the company progresses its plans.”

Methodology

The South Australian Business Index is based on an estimated ‘market capitalisation’, which values each constituent within the Index to enable ranking. For listed entities, given these companies have securities that trade on the ASX, this is readily identifiable using market observation. All listed entities have been valued as at 30 June 2025.

For unlisted entities, HLB Mann Judd has used their professional judgement to estimate a market capitalisation using the market valuation approach.

This approach involves:

- Estimating profit: Assuming available, HLB Mann Judd has adopted the constituent’s profit figure. If only revenue data is made available, a profit margin has been estimated using publicly available statistics of the industry in which the entity operates.

- Determining an earnings multiple: An appropriate earnings multiple is determined based on the nature of the entity, the industry the entity operates in, and listed comparable company and transaction multiples. The selected multiple is then discounted to account for the illiquidity of unlisted entity securities.

- Calculating market capitalisation: The estimated profit is multiplied by the determined earnings multiple.

- Where applicable, valuations are modified to incorporate the value of property/infrastructure that would otherwise not be captured using the above valuation methodology.

Further, assuming data has been provided to InDaily for unlisted entities, HLB Mann Judd has endeavoured to use publicly available data to determine a reasonable market capitalisation estimate.

For more on the state’s top companies, subscribe to InDaily‘s weekly business newsletter Business Insight.

Want to see more stories from InDaily SA in your Google search results?

- Click here to set InDaily SA as a preferred source.

- Tick the box next to "InDaily SA". That's it.