Adelaide offices buck national trend

The South Australian capital’s CBD was one of two markets in Australia to record declines in office vacancy, according to new research.

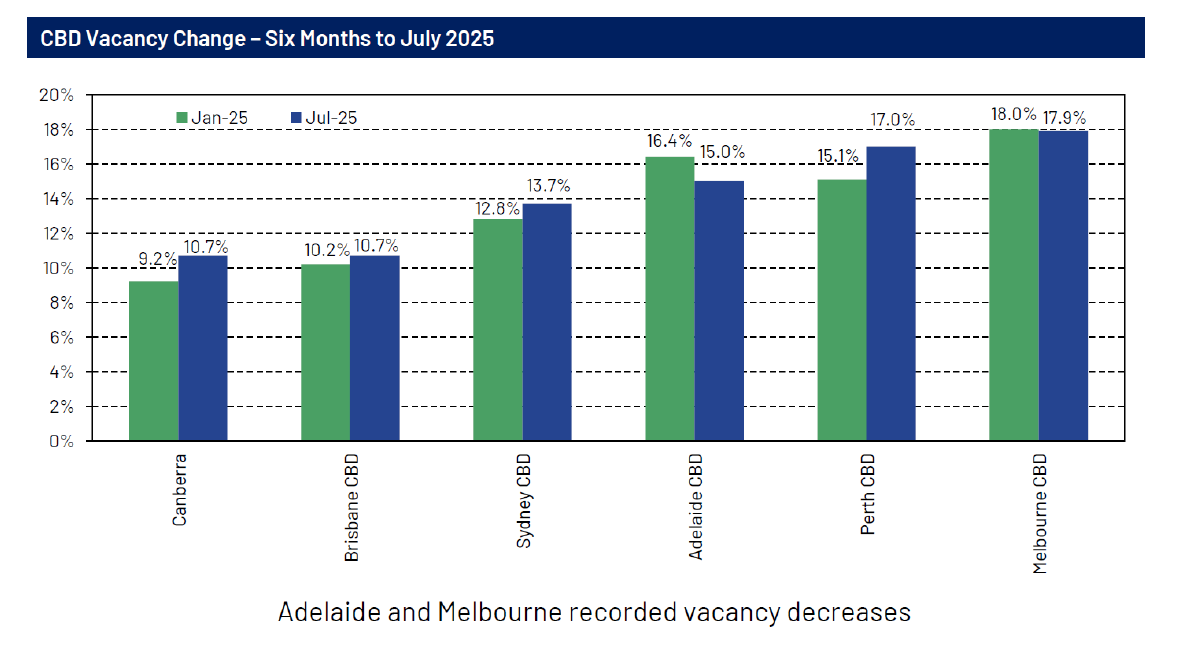

Adelaide CBD office vacancy fell from 16.4 per cent to 15 per cent in the six months to July 2025, bucking the national trend.

The national average vacancy rate rose from 13.7 per cent to 14.3 per cent over the same period, per the new figures from the Property Council of Australia.

The only other capital city CBD to record a decline in office vacancy was Melbourne, falling from 18 per cent to 17.9 per cent. The Victorian capital still has the highest vacancy rate in the nation.

For Adelaide, the vacancy rate decline is the third in a row following a nationwide high of 19.3 per cent 18 months ago.

You might like

Property Council executive director South Australia Bruce Djite said the new figures showed Adelaide “continues to outperform the national market and is well-positioned for the future”.

“Tenant demand is strong, sublease vacancy remains low, and our pipeline is modest and well-pre-committed, all of which put us in a strong position to navigate national market headwinds,” he said.

Adelaide’s upcoming supply represents just 2.7 per cent of CBD stock, with 55 per cent already pre-committed.

Incoming office projects include 42-56 Franklin Street (from Kyren Group), which is expected to be completed later this year, 30 Gouger Street (by ICD Property) due next year and the second Walker Group skyscraper at Festival Plaza.

Stay informed, daily

The Property Council said the city’s fringe office market was “also outperforming”.

“With well-located fringe and CBD office markets performing strongly and positive demand momentum in the past year, there are several reasons to be confident in Adelaide’s medium-term office outlook, notwithstanding more needs to be done for the city to fulfil its full potential,” Djite said.

CBRE office leasing director Andrew Bahr said the city’s “exceptional performance has been driven by sustained demand for high-quality office space, particularly in the 1000sqm+ range, as occupiers seek to consolidate and modernise their workplaces”.

But vacancy in Adelaide’s best buildings “remains extremely tight”, he said.

Regenerated buildings like 30 Pirie Street, 100 King William Street, 55 Currie Street and 45 Pirie Street are generating strong activity, “in some cases surpassing that of newer developments”.

“With upgraded lobbies, end-of-trip facilities, wellness spaces, meeting rooms and lecture theatres, these assets are attracting strong interest from tenants seeking quality without the premium rents of brand-new towers,” Bahr said.

Meanwhile, the defence industry is driving demand both directly and indirectly, Bahr said, and the smaller end of the market was rebounding after a slower Q1, which “suggests renewed confidence among smaller occupiers and a growing economic environment”.

CBRE head of office and capital markets research, Australia, Tom Broderick said in tenants were “thinking less about contraction and more towards expansion”.

“Rents continue to rise around the country, driven partly by higher economic rents of new developments,” he said.

“The supply outlook has moderated over the next five years, which will drive vacancy rates lower and underpin effective rental growth.

“Leasing activity has been slower in some markets in H1 2025, partly due to market volatility from tariffs, the Federal election and high fit-out costs restricting tenant movement. However, we expect increased deal flow in H2 2025 and 2026, with current rental rates likely to be more favourable than in future years.”