Chinese bounce back fails as SA red wine exports on the nose

South Australian wine makers are seeing hundreds of millions drop out of their export market in latest figures. But one Adelaide Hills winemaker tells InDaily it’s “mindblowing” seeing Chinese drinkers reach for a glass of chardy.

Red wine is still on the nose, contributing to the latest figures showing the total value of South Australian wine exports fell by 15.2 per cent to $1.1 billion in 2025, down almost $200 million from the year prior, with a slowdown in the Chinese market mostly to blame.

The total volume of South Australian wine exported also fell dramatically, down 19.6 per cent to 87.2 million litres.

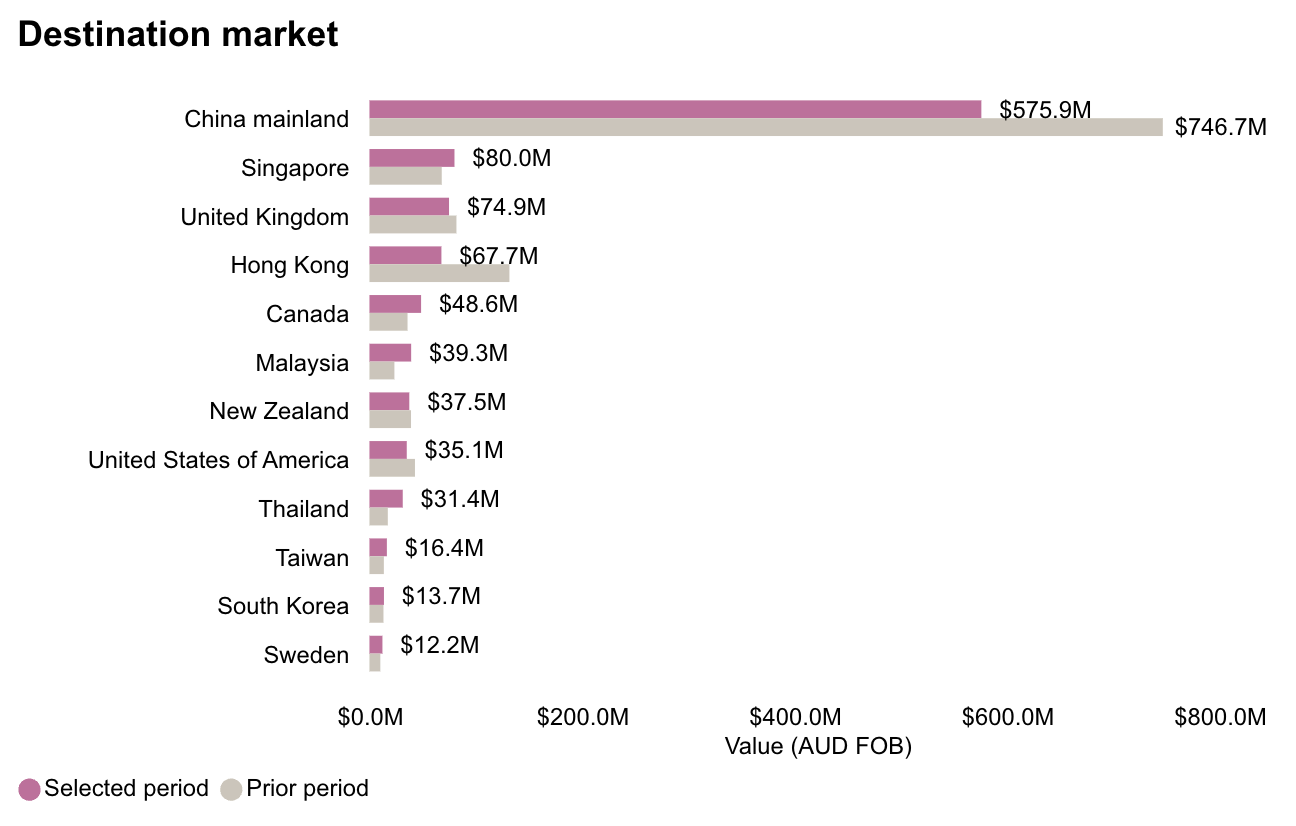

While the expected bounceback in wine exports to China from SA has not eventuated with figures showing exports were just $575.9 million in 2025, down from $746.7 million the year prior.

Owner of Adelaide Hills vineyards and winemakers Longview Peter Saturno said he had seen a “dramatic change in the drinking habits of the Chinese consumer”.

No longer is the market red wine-obsessed, “they’re looking for things that work with their food better”.

“Their knowledge of fine wine has improved incredibly, and they’re looking at different styles of wines; they’re looking at Pinots and Burgundies,” said Saturno, the current proprietor of the family-owned vineyard that’s been operational for 30 years.

“We’ve also seen an increase in white wine too.”

You might like

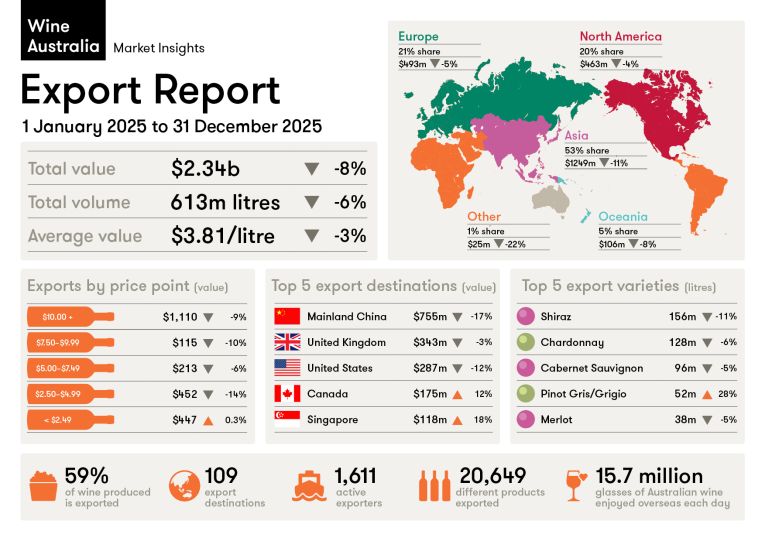

SA’s experience mirrors the national trend, according to Wine Australia’s latest export report, which found total Australian wine exports fell by eight per cent in value to $2.34 billion.

Exports to mainland China from Australia had the biggest impact on the decline in value, Wine Australia said, as shipments to the market were down by 17 per cent year-on-year to $755 million.

Wine Australia market insights manager Peter Bailey said the weakened export performance was consistent with the long-term trend of declining wine consumption in major markets around the world, including China.

“While the re-opening of the mainland China market at the end of March 2024 provided some temporary relief in the decline in total exports, the Chinese wine market is one third of the size it was five years ago – impacting both domestically produced and imported wines,” Bailey said.

“While shipment levels in the first three quarters after tariffs were removed were exceptionally positive, consumer demand has been subdued. Chinese consumer confidence has only made minor improvements since falling to an all-time low in 2022 during the COVID-19 pandemic, which has negatively impacted consumer spending.”

Red wine was the driver of the decline in shipments to mainland China, but exports of white wine increased by 77 per cent in volume, growing to a 15 per cent share of export volume from the previous year.

The top three varieties in white wine exports to mainland China – Chardonnay, Sauvignon Blanc and Riesling – all grew.

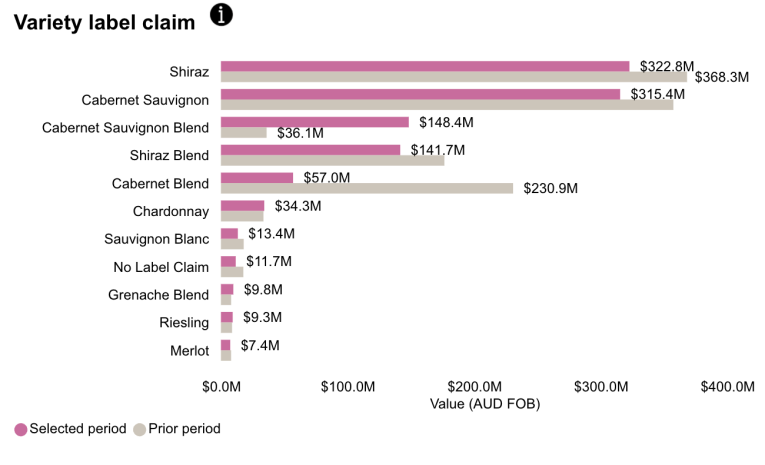

This trend was similar in South Australia, with total Shiraz exports to the rest of the world declining from $368.3 million in 2024 to $322.8 million in 2025.

Stay informed, daily

On a recent trip to Shanghai last year, Longview’s Saturno said he saw young Chinese drinkers enjoying white wine in ice buckets; “it was quite mind-blowing”.

“It made me really happy because we’ve been saying for years that with the Chinese cuisine, white wines work perfectly as a pairing,” he said.

“There are little pockets, but it’s gone back to what I would say is a traditional model that we’re used to with other countries when it comes to importer models in China.”

He’s been enjoying “little wins along the way”, finding that Canada has been a “buoyant and supportive” buyer of Australian wine.

“But our traditional markets in the United States and the UK seem to be haemorrhaging bad,” he said.

“Australia’s perception has been tarnished over the last couple of decades with wines that are a bit same-same.

“Unfortunately, there’s wines hitting the shelves from Australia that are not dynamic; they’re not the ones that we see when we go out to restaurants here, and that’s a sad thing.”

Wine Australia’s Peter Bailey said more than 50 per cent of the volume of Australian wine exports go to the US and UK, markets facing “very tough headwinds” like changing consumer habits and cost-of-living pressures. Export value of Australian wine to the UK and US declined by 3 and 12 per cent, respectively.

“Consumers are reducing overall alcohol consumption in line with wellness trends and in order to save money as the cost-of-living increases,” Bailey said.

“For wine exporters around the world, trade barriers and regional conflicts are also making it more difficult and costly to get product into markets.”

Other changes in South Australian exports include a major collapse in the value of exports of Cabernet Blend. The state exported $230.9 million of the variety in 2024, but just $57 million last year.

Cabernet Sauvignon Blend was a standout performer amidst the downturns, rising from $36.1 million in value to $148.4 million in 2025.